The networking industry stands at a critical inflection point. This year, the memory supercycle that reshaped infrastructure economics throughout 2025 shows no signs of slowing. With DRAM and NAND Flash prices projected to surge another 55-60% in Q1 2026 alone, network architects and IT leaders face a stark choice: absorb escalating hardware costs or fundamentally rethink their approach to network operating systems.

The answer may lie in smarter software.

In this article, you will discover:

- How the 2025-2026 memory supercycle is permanently reshaping networking infrastructure costs

- Why traditional network operating systems are becoming economically unsustainable for access and edge deployments

- How lightweight, optimized solutions like SONiC Lite deliver enterprise-grade functionality without the memory overhead

The Perfect Storm: Understanding the 2026 Memory Crisis

AI’s Insatiable Appetite for Silicon

The root cause of today’s memory shortage is a reallocation of global semiconductor manufacturing capacity. Throughout 2025, the “Big Three” memory manufacturers (Samsung Electronics, SK hynix, and Micron Technology) made a strategic pivot toward High Bandwidth Memory (HBM) production for AI accelerators. This shift has created ripple effects across the entire hardware ecosystem.

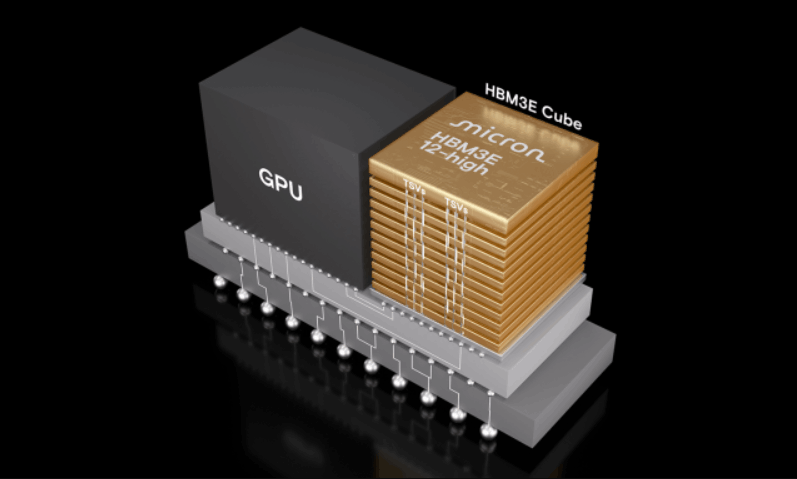

HBM3E 36GB 12-high Solution for the AMD Instinct MI350 (Source: Micron)

The numbers tell a stark story. HBM3E memory utilizes approximately three times as much wafer space as standard DDR5, while delivering profit margins as high as 75%. When manufacturers reallocated advanced process nodes to capture these premium margins, the output of conventional DRAM plummeted. This “wafer cannibalization” effectively removed millions of memory bits from the commodity market.

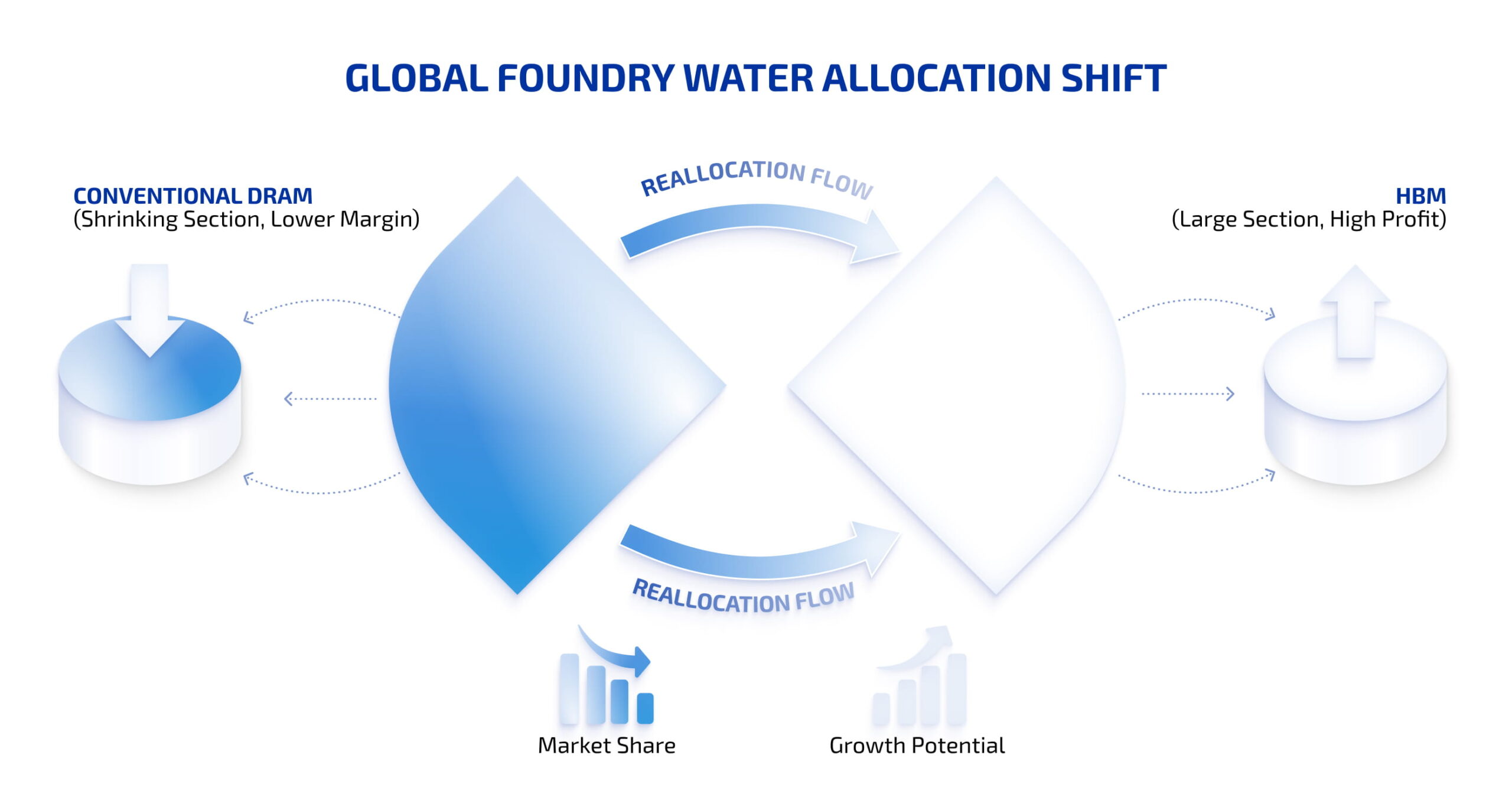

Global Foundry Wafer Allocation Shift

By late 2025, global DRAM inventory levels had collapsed to approximately 8 weeks of supply – down from 31 weeks in early 2023. This depletion gave suppliers unprecedented pricing power. Contract prices for conventional DRAM experienced a 55-60% increase in a single quarter, with DDR5 16Gb chips surging from $6.84 to $27.20 – a 298% year-over-year increase.

The Enterprise Hardware Impact

For networking switch vendors, these price movements translate directly to the bill of materials (BOM). Consider the memory requirements of modern enterprise switches:

- Control plane memory: High-end modular systems like the Arista 7280R3 series require up to 64GB of DRAM and 120GB of SSD storage to maintain routing tables exceeding 5 million IPv4 entries

- Deep packet buffers: AI training workloads demand “lossless” Ethernet with deep buffer switches featuring 16-24GB of high-speed memory to prevent packet loss

- Management plane storage: Network operating systems require substantial NAND Flash for storing OS images and extensive logging data

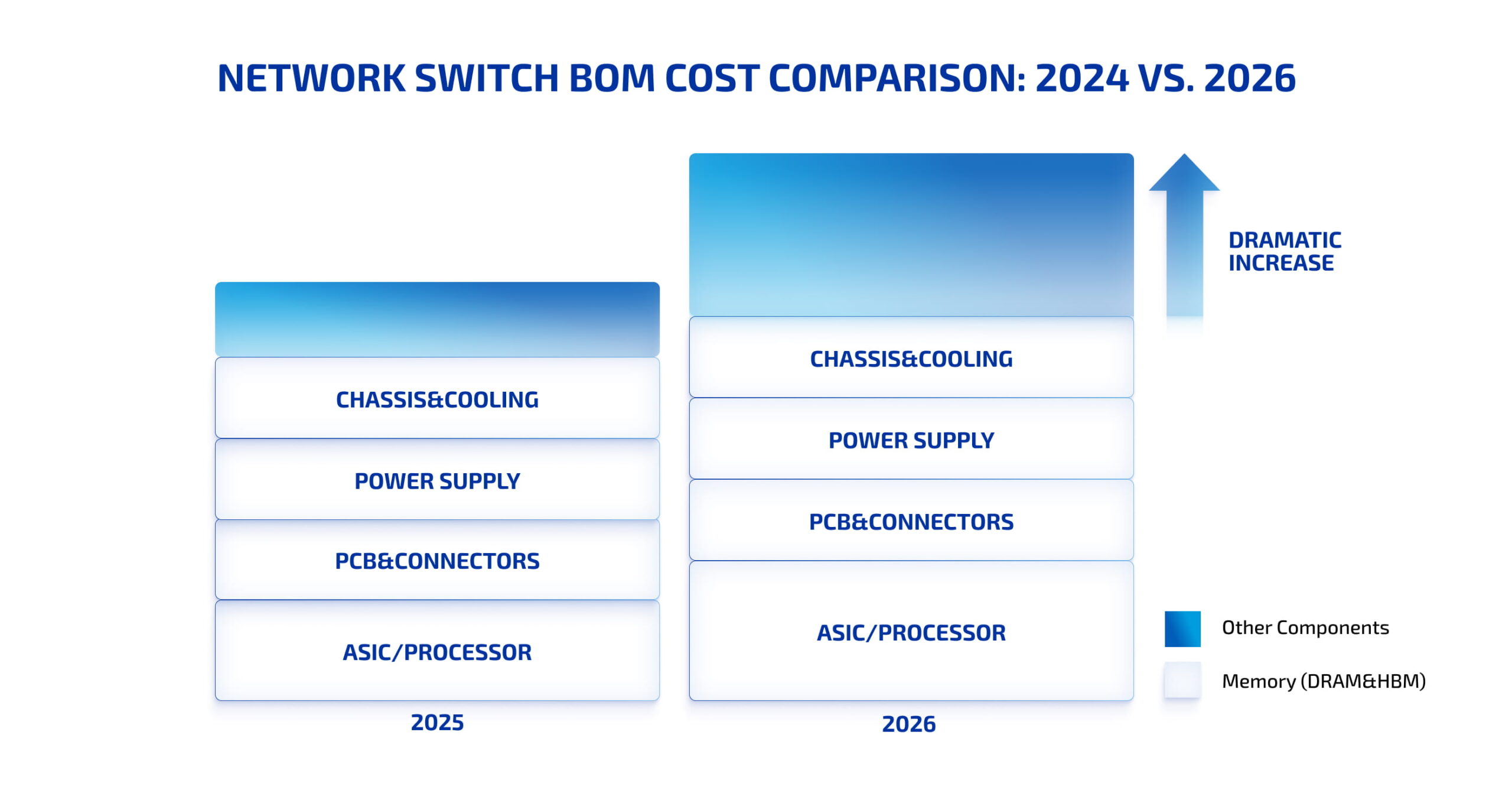

When a 32GB DDR5 RDIMM module surges from $149 to $239 (a 60% increase), and this is multiplied across a 32-switch fabric, the infrastructure cost increase exceeds several thousand dollars purely from memory inflation. For a data center refresh or campus network buildout, these costs quickly escalate into the hundreds of thousands.

Switch BOM costs between 2024 and 2026

The Vendor Response: Price Hikes and Strategic Adjustments

Industry-Wide Price Corrections

Leading networking vendors have been forced to protect their margins through aggressive pricing adjustments:

Cisco Systems implemented a global price increase averaging 3.4-4.0% in late 2025, affecting hardware (effective September 13, 2025) and services (effective October 4-11, 2025) across most product lines. Despite these hikes, Cisco maintained a non-GAAP gross margin of 68.1% in late 2025, demonstrating strong pricing power while pivoting toward higher-margin AI infrastructure orders exceeding $1.3 billion quarterly.

Arista Networks projected Q4 2025 gross margins of 62-63% – a decrease from 65.2% in Q3, reflecting increased costs of memory-intensive components in 400G and 800G systems. To hedge against further volatility, Arista increased purchase commitments to $7 billion to secure long-lead-time components.

Juniper Networks adopted a different approach, adding a 3.5% surcharge on products containing parts from China rather than implementing base list-price increases, allowing them to maintain price list stability while passing through direct costs.

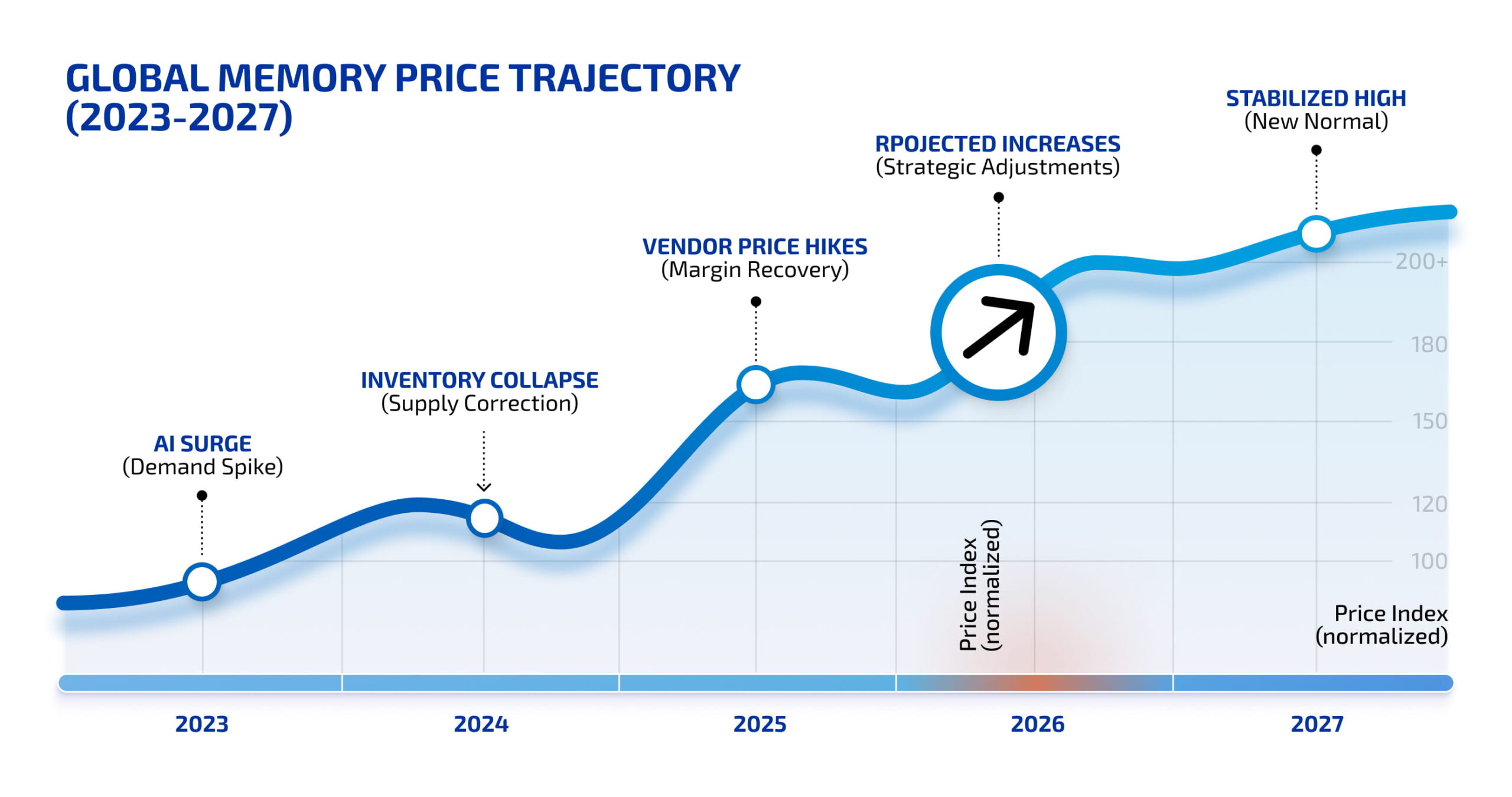

Memory Price Trajectory 2023-2027

The geopolitical dimension compounds these challenges. U.S. tariffs on Chinese-made semiconductors reaching 145% act as a direct multiplier on BOM costs. By Q4 2024, 25GbE switches had already seen price increases of 12%, while enterprise SSDs rose 6% – and these tariffs escalated further in spring 2025.

The Q1 2026 Outlook: More Pain Ahead

Sustained Price Pressure

Industry forecasts for Q1 2026 paint a challenging picture. Preliminary projections indicate conventional DRAM contract prices will rise another 55-60% quarter-on-quarter, while NAND Flash will jump 33-38%. The driver remains consistent: a widening supply-demand gap in the server segment as cloud service providers continue aggressive procurement to secure capacity.

| Memory Segment | Q1 2026 Projected Increase | Primary Driver |

|---|---|---|

| Server DRAM | +60% QoQ | Inventory depletion |

| Client SSDs | +40% QoQ | Capacity shift to enterprise SSDs |

| Blended NAND | +33-38% QoQ | AI infrastructure investment |

| Global DRAM ASP | +20% (Est) | Structural shortage |

The consensus among analysts is clear: the memory shortage and attendant price hikes are not transient. This “supercycle” is expected to sustain elevated prices through at least 2027, as new fabrication facilities won’t come online until late 2028 at the earliest.

The SONiC Lite Advantage: Efficiency by Design

Rethinking the Network Operating System

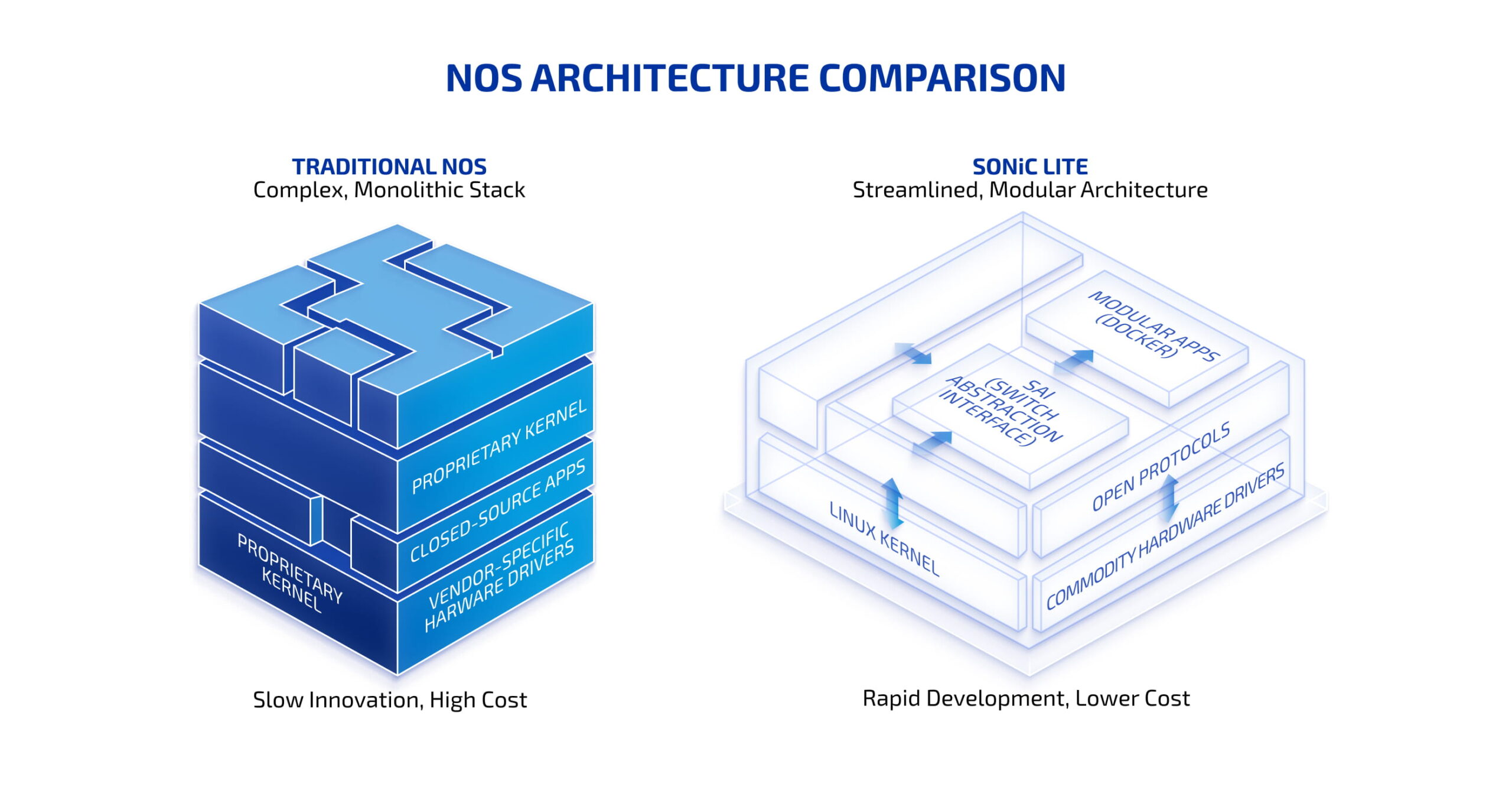

In this environment of escalating hardware costs, the network operating system becomes a critical economic lever. Traditional proprietary NOS solutions were designed in an era of abundant, cheap memory. They carry significant overhead – bloated feature sets that most deployments never use, extensive GUI frameworks, redundant management layers – all consuming precious RAM, storage, and processing cycles.

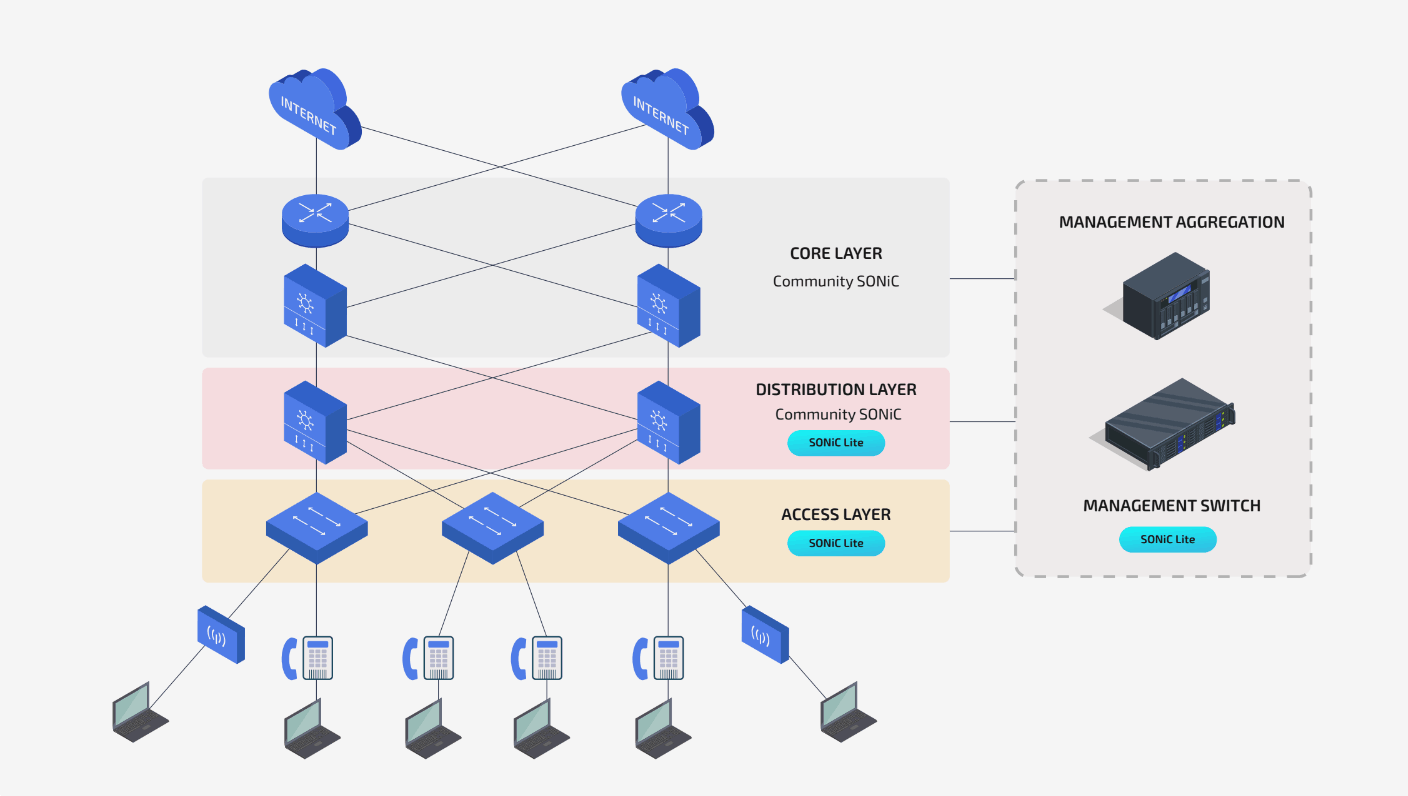

SONiC Lite represents a different approach: a lightweight, streamlined SONiC distribution optimized specifically for resource-constrained switches. Built on the same proven foundations as Community SONiC (the hyperscaler standard), SONiC Lite strips away unnecessary overhead while retaining enterprise-grade functionality.

Proprietary NOS vs. SONiC Lite

The latest release further strengthens its enterprise capabilities with MC-LAG redundancy for mission-critical deployments, nested VLAN support for complex network segmentation, and enhanced real-time monitoring.

Optimized for Lean Hardware

SONiC Lite’s architecture delivers several critical advantages in the current memory crisis:

Reduced Memory Footprint: By eliminating redundant features and optimizing core networking functions, SONiC Lite runs effectively on hardware with 30-50% lower RAM requirements than traditional NOS solutions. This directly translates to lower TCO – especially critical when server-grade memory has surged 60% year-over-year.

Lower Storage Requirements: With a streamlined codebase and modular feature selection, SONiC Lite requires significantly less NAND Flash for OS storage. In an environment where enterprise SSD prices have spiked 30-35% quarterly, this creates meaningful savings across distributed deployments.

CPU Efficiency: Optimized packet processing and control plane operations mean SONiC Lite performs well on lower-cost processors, further reducing switch costs without compromising performance.

The complete SONiC Lite Hardware Compatibility List can be viewed here.

The Right-Sized Solution

SONiC Lite excels precisely where full Community SONiC has historically been too resource-intensive:

- Access layer switches: Campus, branch, and edge deployments where thousands of devices multiply any per-unit cost increase

- Management plane switches: Out-of-band management and console servers where functionality matters more than raw throughput

- Aggregation layer: Distribution switches that need robust features without data center-scale packet buffers

- Edge computing: Compact platforms where power, space, and cooling constraints demand efficiency

By deploying only the features each use case requires, organizations avoid paying the “memory tax” on functionality they never use.

Breaking Free from Vendor Lock-In

The Economic Case for Open Networking

Beyond memory efficiency, SONiC Lite’s open architecture delivers strategic advantages that become more valuable as proprietary vendor costs escalate:

Hardware Freedom: Deploy on affordable whitebox platforms from multiple vendors, avoiding the 30-50% premium that branded switches command. When Cisco, Arista, and Juniper all raise prices simultaneously, having hardware alternatives becomes a negotiating superpower.

Software Independence: No proprietary subscription fees that scale with your deployment. No forced upgrade cycles tied to vendor product lifecycles. No feature gates that require “premium” SKUs.

Extended Lifecycle: Regular software updates, feature backports, and security patches keep hardware relevant longer. When new switches cost 20% more due to memory inflation, extending existing infrastructure from 5 to 7+ years delivers massive ROI.

Procurement Flexibility

In the volatile market of 2026, procurement agility is invaluable. SONiC Lite enables:

- Multi-vendor sourcing: Quote from multiple hardware suppliers to capture regional pricing advantages and avoid supply chain bottlenecks

- Opportunistic buying: When market conditions create temporary price dips, purchase whitebox hardware and deploy your standardized SONiC Lite image

- Secondary market leverage: Certified pre-owned whitebox switches become viable when your NOS is hardware-independent

Enterprise-Grade Features Without Enterprise-Scale Overhead

Access Layer Functionalit

SONiC Lite isn’t a stripped-down toy – it’s a purpose-built distribution that delivers the features enterprises actually need for access and aggregation deployments:

- PoE support: Power access points, IP phones, and IoT devices

- 802.1x authentication: RADIUS integration for network access control

- MACsec: Layer 2 encryption for security-sensitive environments

- Advanced VLAN management: Enterprise-grade segmentation and isolation including nested VLAN (Q-in-Q) support for multi-tenant architectures and service provider scenarios

- Quality of Service: Intelligent traffic classification and prioritization for voice, video, and critical applications with enhanced QoS capabilities

- MC-LAG redundancy: Multi-chassis link aggregation eliminates single points of failure, providing seamless failover protection for business-critical workloads

These capabilities run efficiently on hardware that costs 30-50% less than equivalent branded switches – a delta that grows as memory prices climb.

Seeking out SONiC Distribution

for cost-effective management

and access switches?

Download the SONiC Lite product brief to explore detailed features, supported use cases, and the current hardware compatibility list.

Management and Automation

Modern network operations demand programmatic control. SONiC Lite provides:

- Full API exposure: RESTful APIs for infrastructure-as-code approaches

- Configuration management: Integration with Ansible, Terraform, and other automation frameworks

- Telemetry streaming: Real-time operational data for monitoring and analytics platforms

- Zero-touch provisioning: Automated deployment for distributed sites

Real-Time Event Monitoring enables instant notifications for critical infrastructure changes, including link state transitions and PoE activity. Switch Support Bundle streamlines the troubleshooting workflow by automatically packaging comprehensive diagnostic information in analysis-ready formats.

Together, these capabilities deliver the operational intelligence traditionally available only in expensive proprietary network management platforms, while maintaining SONiC Lite’s lightweight footprint and cost efficiency. For organizations deploying hundreds of switches across campus or branch locations, OLS transforms network operations from a resource-intensive burden into a streamlined, data-driven process.

SONiC-Based Open Network Infrastructure

This cloud-native approach reduces operational overhead even as network scale increases – a critical advantage when IT budgets face competing demands.

SONiC Lite Free Demo

Implement SONiC on cost-effective platforms with SONiC Lite

Strategic Imperatives for 2026

Adapting to the New Normal

The memory supercycle isn’t a temporary disruption – it’s a structural transformation that demands strategic response:

- Audit Your Memory Exposure: Map your network infrastructure to understand which devices are most memory-intensive. Access and edge switches deployed by the hundreds are where SONiC Lite’s efficiency creates maximum impact.

- Challenge the Status Quo: Question whether your current NOS vendor provides commensurate value for their pricing premium. Calculate the “memory tax” you’re paying for features you don’t use.

- Build Optionality: Even if you’re not ready to fully transition to open networking, pilot SONiC Lite in non-critical segments. Develop internal expertise and validate the economic model.

- Extend Lifecycles: With memory-driven hardware costs up 20%+, maximizing the useful life of existing infrastructure through software updates becomes financially compelling. SONiC Lite’s ongoing development means platforms remain current longer.

- Embrace Disaggregation: Separate hardware purchasing decisions from software platform choices. This flexibility becomes increasingly valuable as component prices fluctuate.

The OEM Opportunity

For original equipment manufacturers and hardware vendors, SONiC Lite represents a strategic enabler:

- Faster Time-to-Market: Ready-to-integrate NOS foundation eliminates years of development

- Reduced R&D Costs: Leverage SONiC ecosystem instead of building proprietary software

- Market Differentiation: Offer SONiC compatibility as a competitive advantage in RFPs

- Lower BOM Costs: Optimize hardware for SONiC Lite’s efficient resource usage, enabling competitive pricing even with elevated memory costs

When hardware margins are compressed by component inflation, reducing software development costs and enabling lower-spec hardware configurations creates breathing room.

Conclusion: Efficiency as Strategy

The 2026 networking industry demands a fundamental reassessment of how we architect, procure, and operate network infrastructure. As memory prices continue their relentless climb – with another 55-60% increase projected for Q1 2026 – the “memory tax” on traditional networking approaches becomes unsustainable.

SONiC Lite offers a proven path forward: enterprise-grade open networking optimized for resource efficiency without compromise on functionality. By deploying only what each use case requires, running on cost-effective whitebox hardware, and eliminating proprietary lock-in, organizations can achieve 40-50% TCO reductions while building more flexible, future-proof networks.

The memory supercycle won’t end soon. New fabrication capacity won’t arrive until 2028 at the earliest. AI’s appetite for HBM continues to cannibalize commodity memory production. In this environment, efficiency is an essential business strategy.

The question isn’t whether memory costs will remain elevated. The question is whether your network architecture can thrive despite them.

If you’re planning a network refresh, evaluating alternatives to proprietary vendors, or looking to optimize your infrastructure TCO in the face of component price volatility, our team can help you assess your options and architect a solution that meets your technical and economic requirements.